Have you heard the term IFTA reporting but are wondering if it applies to your fleet or if there are alternate options? Do you have an IFTA license but need to know what is required to fill out the report? We’re going to answer those questions for you.

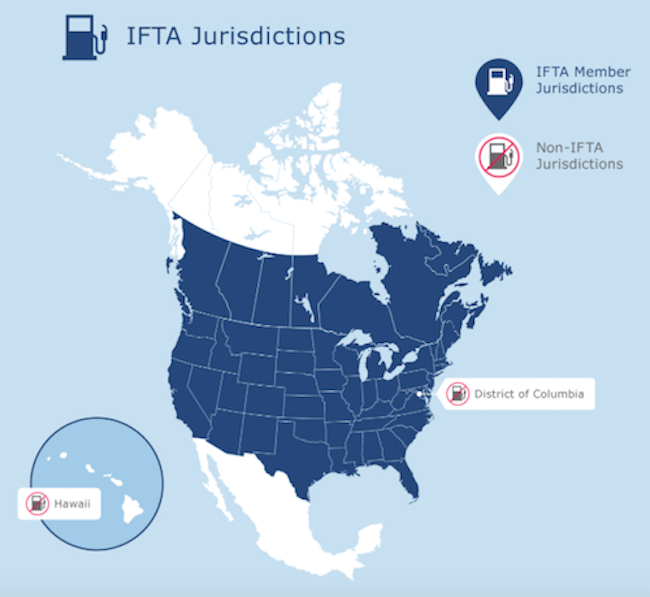

First, let’s briefly review what IFTA is. The International Fuel Tax Agreement is an agreement amongst jurisdictions in the U.S. and Canada for collecting fuel use taxes. More about IFTA history here.

It is intended to give fuel use tax revenue to all jurisdictions your fleet vehicles drive through, whether you purchase fuel there or not. The revenue is applied to maintaining that jurisdiction’s roads and highways.

Who's required to report IFTA?

A vehicle requires IFTA reporting if:

- It is operated in at least two IFTA member jurisdictions

- And meets one of the following criteria:

- Has at least three axles

- Has two axles plus a gross weight of over 26,000 pounds (11,793 kilograms)

- Is used in a combination with a gross weight of 26,000 pounds (11,793 kilograms)

Of course, there are always some exceptions, so check to see if this includes your fleet.

If you need to apply for an IFTA license, you can do so via an application from your home state or province.

Completing a quarterly IFTA report

Required information

There are a number of items you will need to track each quarter for your IFTA reports, and it can get tedious. Regardless, you’ll want to make sure you are aware of these items from the start to avoid scrambling come report due date time.

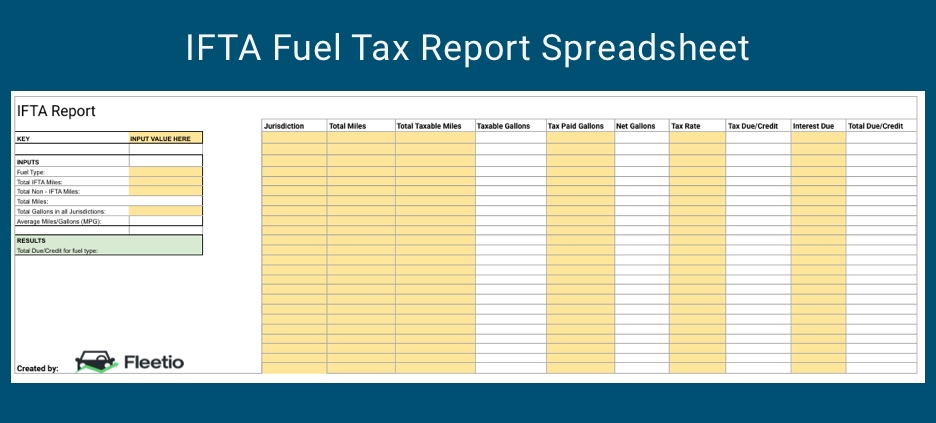

For all qualifying vehicles and for each fuel type, you are required to track and compile the following for your IFTA report:

- Total miles and taxable miles traveled in each member jurisdiction

- Tax-paid gallons purchased in each member jurisdiction

- Total miles traveled, including non-member jurisdictions

- Total gallons of fuel consumed including non-member jurisdictions

Here’s an example of an IFTA tax report form for Georgia.

Download this free spreadsheet to track fleet metrics for IFTA reporting.

Tax-paid gallons purchased are gallons of fuel purchased at the pump that include tax. You will need to keep all fuel receipts to provide a record for this amount and to record the date of your fuel purchase, seller’s name and address, fuel type, number of gallons purchased and price per gallon—all information required for IFTA. If you have a fleet management software with fuel card integration, this information will be tracked automatically.

When it comes to recording miles traveled for IFTA, fleets use a variety of methods. Common strategies include manually recording miles traveled or the odometer reading every time you cross state lines, measuring the trip distances in Google Maps at a later date or using an IFTA-approved software that tracks your miles traveled. Ultimately, the best method will depend on your fleet and whichever invokes the greatest accuracy and compliance from drivers.

It is important all your records add up, so resist the temptation to simply estimate your trip mileage. Maintain as detailed trip records as possible including tracking any detours or additional stops you have to make while driving.

Deadlines and fines

IFTA reporting is something your fleet will need to take care of every quarter. If it falls off your radar and you submit the report late or not at all, your fleet will be fined $50 or 10 percent of the net tax liability, whichever is greater. So, make sure you save the following report due dates in your calendar:

IFTA Reporting Periods | |

|---|---|

| January - March | April 30 |

| April - June | July 31 |

| July - September | October 31 |

| October - December | January 31 |

Keep in mind that if you do not operate during a certain quarter period, you will still need to submit an IFTA report with zero miles.

Now you are prepared to start completing IFTA reports! Be on the lookout for more blog posts from us on IFTA to master the process.