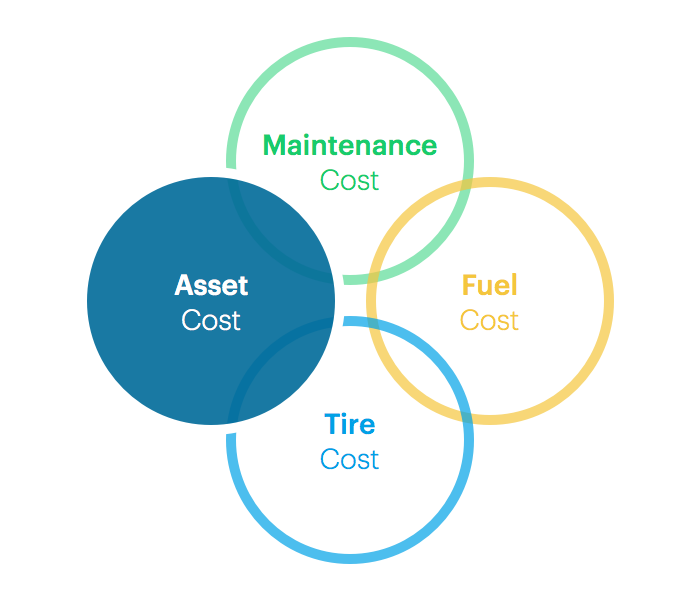

To be a better fleet manager, you need to understand four major cost factors of your fleet. In this post, we'll discuss Asset Costs.

Asset Costs

The asset cost should include:

- Total cost of acquisition of each vehicle

- Supporting devices and equipment installed on the unit

- Insurance and licensing of the vehicle and supporting equipment

At the end of the equipment’s life, there is also a disposal cost that should be included here. Any income received from the sale of an individual piece of equipment should be credited against the asset cost.

Now that you’ve discovered more about asset costs, think about these as they apply to your business.

- How have you structured the acquisition of assets? Do you have a plan?

- Do you have a specific vendor or do you scramble at the last moment to find a replacement vehicle and equipment when the need arises?

For those just getting into fleet management on a formal basis, or for those who are attempting to analyze costs in order to better understand where expenses originate, here are a few simple suggestions. We have all used the phrase “think outside of the box”. That is a simple phrase, but it assumes that a person understands what the “box” is. You might try to first determine where your company’s “box” is when it comes to asset costs. Thinking outside of the box is often one of the first things you need to do when attempting to lower or control costs.

The asset box: only thinking about acquiring new vehicles.

When in this box, the company may find that all of the accessory shelving and storage must also be new.

For instance, Ford has replaced the E-Series with the Transit. If your company is Ford-only, then you will find that your shelving and storage inside your vehicles probably has to be replaced because of new interior dimensions. One outside-of-the-box practice for acquiring vehicles is to consider used.

If your company’s average vehicle travels 30,000 miles per year and you replace every eight years, you may find that acquiring a unit with 100,000 miles at four-years-old could cost one-third of the price of a new vehicle and would still give you four or five years use at your annual mileage.

Read the next post in the series now »

Post Contributor: Jim Russell, Fleet Management Consultant