IFTA Reporting and Tax Filing

Simply your IFTA reporting and tax filing process

Quarterly IFTA reporting can be a haggle for fleets. With Fleetio, you can report on fuel usage across multiple jurisdictions in a fraction of the time. Remain compliant with a dedicated IFTA reconciling tool and automate fuel data collection.

Download IFTA Toolkit

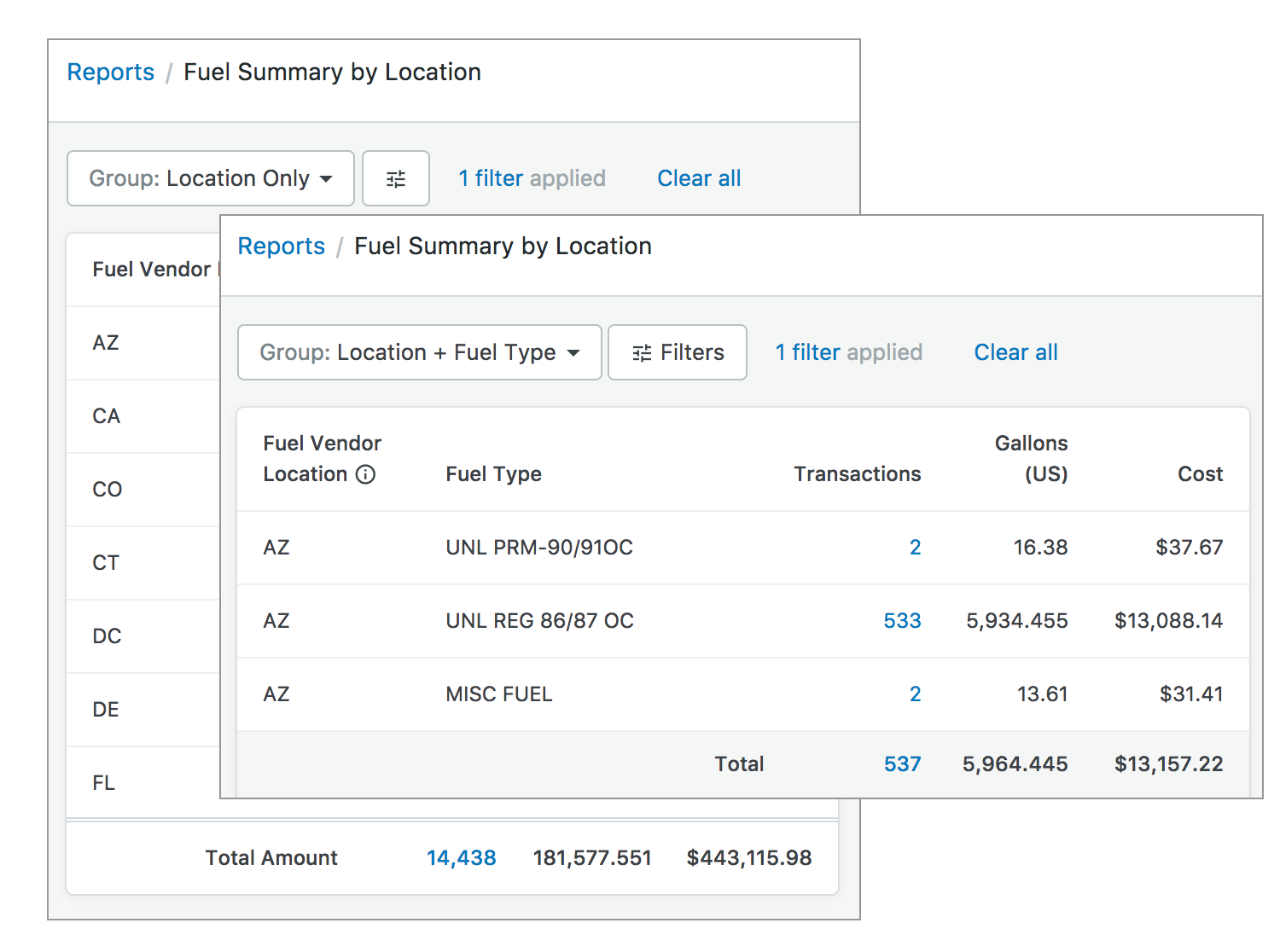

Simply fuel management and summary reporting

Aggregate your fuel data by location with Fleetio’s Fuel Summary by Location Report. Prepare your fuel entries by state, region or province and fuel type while eliminating data entry. It’s like having your own dedicated IFTA reporting assistant. Learn more

- Organize fuel transactions by location (state/region/province) and fuel type

- Streamline the IFTA reporting process

- Export fuel data by location with one click

- Reduce clerical errors from manual data entry

Get the IFTA toolkit

Download this exclusive IFTA toolkit to help streamline quarterly fuel tax reporting

This kit contains IFTA reporting guides and other IFTA content covering:

- IFTA qualifications and completing your quarterly fuel tax report

- Reduce time spent on data gathering for reporting

- Sample fuel tax report template

- IFTA audit procedures and tips

- Most common mistakes and how to avoid them

- IFTA basics and requirements